May 21st, 2024

The $39.8 million golf entertainment destination at CityGate is expected to create 200 temporary construction jobs, at least 200 permanent full- and part-time jobs and generate up to $250 million in local economic impact over the next decade.

Spanish Language Version (PDF)

Monroe County Executive Adam Bello today announced the County of Monroe Industrial Development Agency approved a package of tax abatement incentives for Topgolf, a premier golf entertainment complex proposed for CityGate in Brighton. The Topgolf project is predicted to become a significant regional tourism magnet, to produce at least 200 full- and part-time jobs, and, according to the company, to contribute as much as $250 million to the local economy over the next 10 years.

“This is great news for Monroe County. Adding Topgolf to CityGate doesn’t just give us a premier entertainment and tourism destination; the decision to build one of just 100 Topgolf facilities in the nation right here in Brighton signifies the strength and potential of our local economy,” said Monroe County Executive Adam Bello. “Historically, Monroe County has thrived when we’ve embraced innovative projects that inject energy and economic vitality into our region. From the development of the Eastman Business Park to the revitalization of the Inner Loop, we’ve witnessed the transformative power of strategic investments. PILOT agreements have been instrumental in these successes, providing the necessary incentives for businesses to choose Monroe County as their base of operations. The tax incentives we provide today will be recouped manifold through increased property values, higher sales tax revenues, and a more robust job market. Topgolf’s decision to build here is a signal to other high-profile businesses that we are a prime destination for investment.”

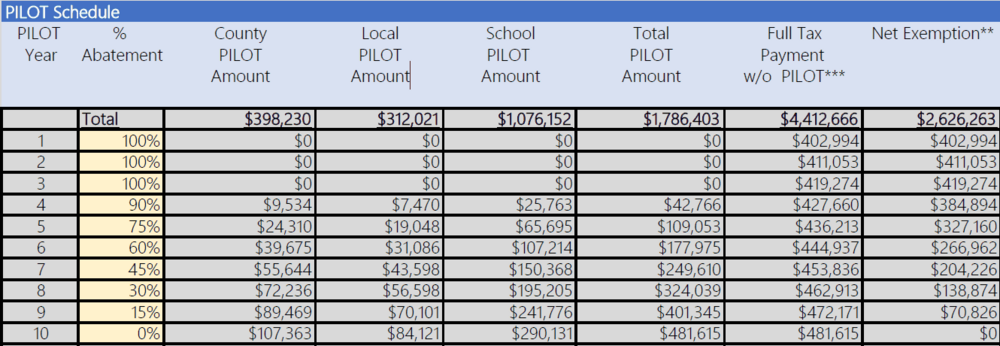

Under the COMIDA agreement, Topgolf will enter into a 10-year payment-in-lieu-of-taxes (PILOT) contract. PILOT agreements stabilize property tax expenses by allowing developers to make predetermined annual payments that typically increase at a fixed rate each year. For Topgolf, the agreement stipulates that Topgolf will continue to pay full taxes on the existing assessed value of the land but no payments on the increase in assessment as a result of the project for the first three years. Full taxes on the assessed value of the land will continue and payments on the increase in assessment will begin in the fourth year and gradually increase until, by the tenth year, Topgolf will be paying taxes on the property’s full assessed value. This agreement results in approximately $2.6 million in property tax exemptions. (See page 2 for an outline of PILOT payments)

Additionally, the project will receive up to $1.6 million in sales tax exemptions on construction materials and equipment, as well as an exemption of up to $197,500 on mortgage recording tax. All exemptions for the project total approximately $4.3 million, spread over 10 years.

Outside the COMIDA agreement, Topgolf has entered into a host community agreement with the Town of Brighton, whereby Topgolf will pay the town an amount equal to the real property tax abatement provided under the PILOT, thereby making the town “whole.”

The Topgolf facility will comprise a 48,282-square-foot building with a 1,200-square-foot event space, 80 hitting bays with a 205-yard long outfield and a full-service restaurant and bar. The developer will also make off-site improvements including to the CityGate entrance, roadway, smokestack structure and signage. The complex is expected to draw approximately 250,000 annual visitors from upstate New York and neighboring states.

Construction on the project could begin as early as this summer, with an anticipated opening by summer of 2025.

TOPGOLF BY THE NUMBERS:

Construction investment: $39.8 million

Jobs created: up to 246 temporary construction, up to 253 permanent full- and part-time operational jobs

Estimated annual payroll: $12 million

Estimated direct community economic benefit (calculated for COMIDA by MRB GROUP cost- benefit analysis tool, includes payrolls, increase in property tax revenue, sales tax and income tax revenues over 10 years. Does not include indirect impact on the local economy through re- spending by vendors/suppliers or households): $145 million

Estimated annual value of tax abatements provided by COMIDA: $431,000

Also approved for COMIDA assistance during today’s meeting was a proposal by DelMonte Development LLC for a $42.8 million, 191-room hotel within the CityGate Development. The hotel would be dual-branded by Element by Westin and AC Hotels by Marriott. This project is expected to create 33 new jobs and generate economic benefit for the community (including payroll, increased property tax revenue, sales and income taxes) of $94 million over 10 years.